Understanding Use Tax

When making a sale, businesses widely understand their obligations when it comes to collecting sales tax. But use tax can be a little trickier, even though it is the flip side of the same coin. Use tax is typically paid in place of a sales tax when a buyer purchases from a seller located in a different state than where the product or equipment is being used. If the seller does not have a presence, or nexus, in the buyer’s state, then sales tax may not be charged and the buyer is supposed to pay the use tax to the taxing authority.

Use tax can be complicated because different states — and municipalities — have different requirements for what kinds of purchases are covered by the tax and the rate typically varies between taxing bodies. When it comes to foodservice equipment sales, dealers that commonly do business in one market may not be familiar with the rules in another area. Further, if the buyer fails to pay the tax, the dealer might still be considered liable and the state could assess a penalty with interest on the dealer. While the dealer may be able to fight such claims, the messier nature of use tax can make it difficult. “A defense here might be to prove that the purchaser paid use tax (either voluntarily or as a result of an audit they went through), but this requires coordination with the purchaser, which may or may not be easy,” notes Chris Wilson, a partner at the Holland & Knight law firm.

“Because states have varying laws in this area, it is important to obtain guidance to ensure that you have an understanding of how states classify transactions, how tax applies and the extent to which any exemptions might apply (along with any certification requirements),” Wilson adds.

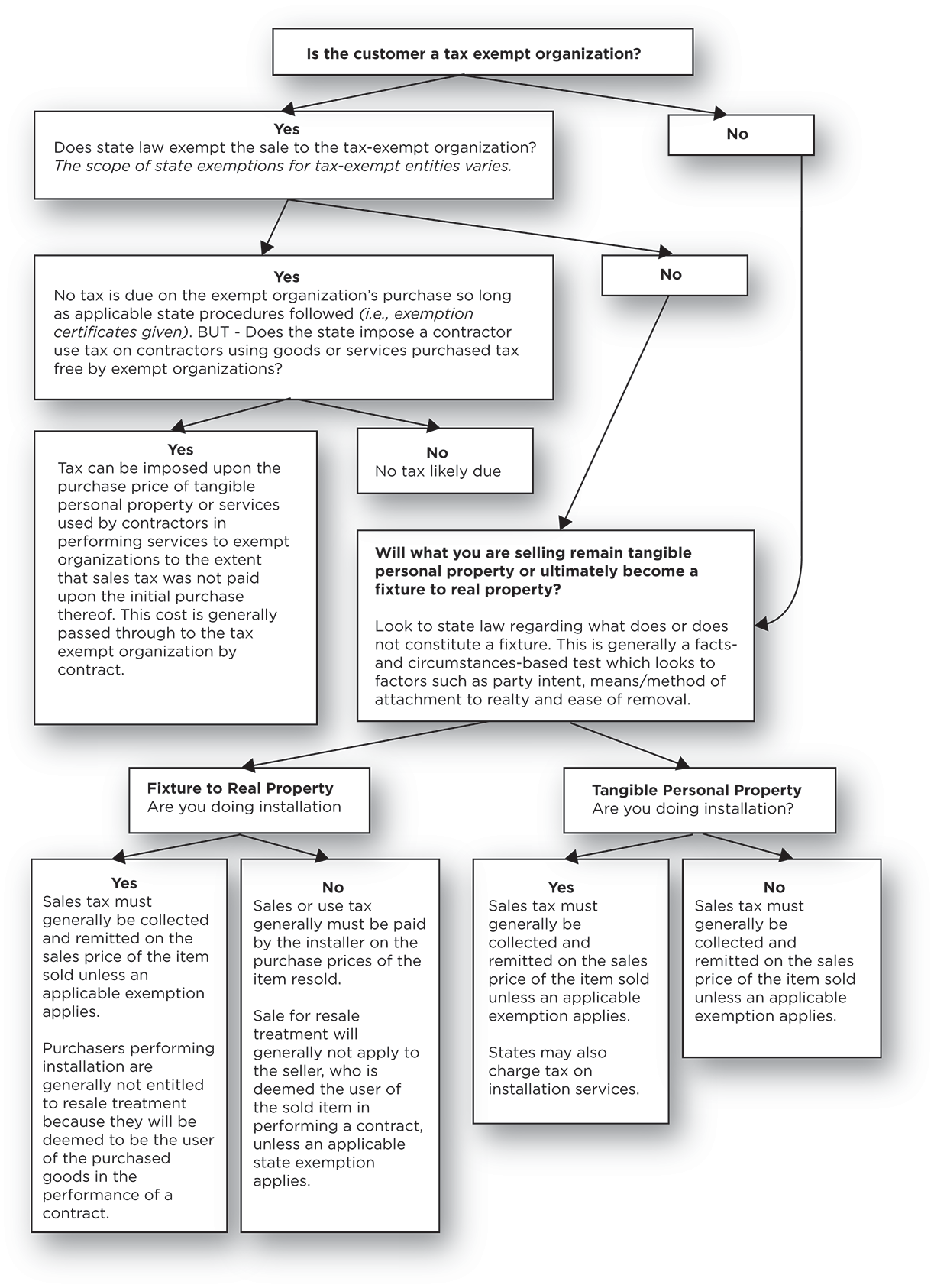

The flow chart on this page is designed to help dealers determine how and when to apply sales or use tax in most situations. FEDA will continue to work with Holland & Knight to develop additional resources and share more information in the coming months.